The employment prospects for actuaries are excellent. Having an actuary on staff has advantages for many organisations, including insurance companies, banks, and other financial firms. But what exactly is actuarial science, and might you make a career out of it?

What is Actuarial Science?

Actuarial science is a profession that uses statistical and mathematical techniques to analyse risks and provide solutions to complex issues in insurance, banking, and other industries. This will guarantee that the businesses operating in such industries are currently and indefinitely financially stable.

As a student of actuarial science, you will learn how to use the principles of mathematics, statistics, and probability to predict future events, verify the likelihood that those events will occur, and then take the necessary precautions to reduce the risks and economic impacts associated with those events. In addition to the apparent maths, probability theory, and statistics, this subject also involves a variety of other closely connected fields, including finance, economics, and computer science.

What do you learn in Actuarial Science?

Potential areas of Actuarial Science study include the following:

- Advanced Calculus

- Corporate Finance

- Derivatives

- Fundamentals of Linear Algebra

- Insurance Practices and Takaful

- Life Contingencies

- Macroeconomics

- Mathematical Statistics

- Probability Theory

- Programming

In actuarial science, there are numerous calculations and issues to be resolved. You must have expertise in mathematics, specifically numbers.

Do you require assistance in determining whether an actuarial career is the right fit for you? Contact one of our experienced consultants immediately!

Skills Needed to Study Actuarial Science

1. Analytical Problem Solving Skills

Actuaries must be good at solving analytical problems because one of their responsibilities is to analyse complex data and spot patterns and trends that can be used to pinpoint the causes of particular results. Actuaries seek out strategies to reduce the risk of unpleasant outcomes or the expense of realising an undesirable end after considering and comparing the significance of these aspects.

2. Communication and Interpersonal Skills

Actuaries frequently collaborate with other staff members, such as programmers, accountants, and senior management, making good interpersonal and communication skills crucial. Strong writing abilities make sure that results and solutions are easily understood in notes and written reports, while strong language skills allow actuaries to convey difficult technical and statistical aspects to a variety of audiences.

3. Computer Skills

Actuaries use a variety of statistical modelling programmes and computers as their tools of the trade. Actuaries typically analyse enormous amounts of information using models and tables. Basic computer proficiency, familiarity with Microsoft Office, and the ability to write in a statistical programming language are all absolutely necessary.

4. Knowledge of Business and Finance

Actuaries are frequently employed by businesses, banking firms, and insurance companies. As a result, they are in charge of assessing insurance or pension plans, giving businesses advice on how to reduce financial risk exposure and giving banks professional advice on how to maximise profits for a variety of investment products. A solid knowledge of business and financial principles is necessary for this.

5. Maths Skills

Actuaries work with numbers, so it goes without saying that they must be able to rapidly and accurately perform basic arithmetic. But actuarial science’s maths can occasionally be more challenging. Calculus, statistics, and probability expertise are also necessary for actuaries because they measure risk and estimate the possibility of various outcomes.

Career Options for Actuary Graduates

One of the following jobs is possible for you:

- Accountants

- Actuarial Analyst

- Auditors

- Budget Analyst

- Chartered Accountant

- Economist

- Forensic Accountant

- Mathematician

- Personal Financial Advisor

- Statistician

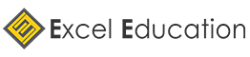

General Pathway of Becoming an Actuary in Malaysia

You must complete the Pre-University programme after SPM/IGCSE/O-Levels. Before enrolling in a Bachelor of Actuarial Science programme, you can choose to pursue a Foundation, STPM, or other equivalent qualifications.

Apply for a Actuarial Science Bachelor’s degree in Australia for 3 years. You need to have a high level of competency in English with a minimum score of IELTS or TOEFL. A two-year Post-Study Work (PSW) visa will then be available to you, once you complete your Bachelor’s degree.

You must advance your education by passing professional tests like the SOA or IFoA if you want to become an actuary. Most actuaries in Malaysia belong to one of the actuarial bodies.

By passing professional exams, it could take you 3–7 years to become a qualified actuary.

Note: The professional papers for several Actuarial Science Bachelor’s degrees are excluded. Reach out to us to learn more!

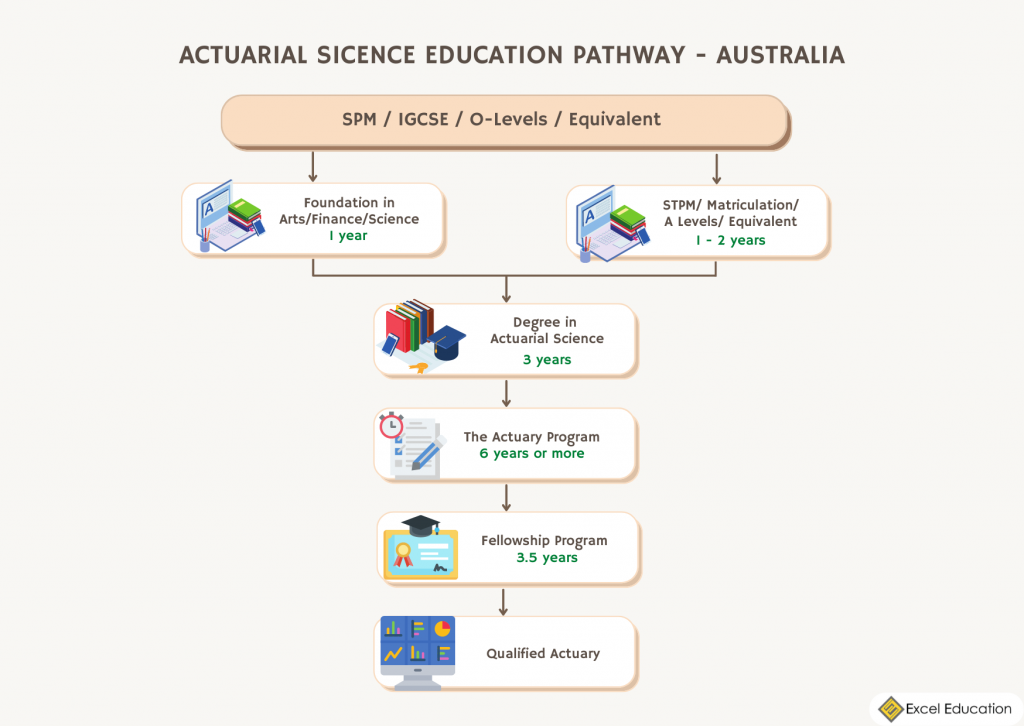

General Pathway of Becoming an Actuary in Australia

You must complete the Pre-University programme after SPM/IGCSE/O-Levels. Before enrolling in a Bachelor of Actuarial Science programme, you can choose to pursue a Foundation, STPM, or other equivalent qualifications.

Apply for a Actuarial Science Bachelor’s degree in Australia for 3 years. You need to have a high level of competency in English with a minimum score of IELTS or TOEFL.

Following completion of your bachelor’s degree, you must complete The Actuary Program to become an AIAA (Associate of the Institute of Actuaries of Australia).

Last but not least, the Fellowship Program will strengthen and specialise your professional education, and the Fellow title gives you additional employment opportunities.

General Entry Requirements to Study Actuarial Science in Australia

i) Academic Entry Requirements

Australian Matriculation (ATAR) | Minimum 92 |

Great Britain General Certificate of Education (GCE A levels) | Minimum 12 |

IB Diploma | Minimum 33 |

Matriculation | Minimum CGPA 3.40 |

STPM | Minimum 3 passes |

UEC | Minimum of Grade Average A1 |

Note: Universities may have different requirements. To learn more, get in touch with us!

ii) English Language Entry Requirements

IELTS | Minimum 6.5 |

TOEFL | Minimum 80 |

Note: Universities may have different requirements. To learn more, get in touch with us!

Top Australia Universities to Study Actuarial Science

# 1 The University of New South Wales (UNSW Sydney)

UNSW Sydney is a founding member of the Group of Eight, an Australian research-intensive university group. UNSW is a research institution that was founded in 1949 and is now ranked 43rd in the world by QS World University Rankings. It is a member of Universitas 21, an international network of research universities. Over 200 universities around the world have exchange and research connections with it.

The university offers bachelor’s, master’s, and doctorate degrees through its seven faculties. The main campus is located in Kensington, a Sydney suburb 7 kilometres (4.3 miles) from the city’s central business district (CBD). New South Wales has a number of research sites spread across the state.

Programme Offered | Major Electives offered include:

|

Intake | Feb, May, Sept |

Duration | 3 years (full-time) |

Indicative Fees (2022) |

Contact us right now for a free consultation if you’d like more details about the costs, the format of the programme, and the entry requirements!

#2 Monash University

Monash University, the second oldest university in Melbourne, Victoria, was founded in 1958 and is named after Sir John Monash, a World War I general. The university includes four campuses (Clayton, Caulfield, Peninsula, and Parkville) in Victoria, as well as a dynamic network of teaching sites in Malaysia, Italy, India, and China. It is Australia’s largest university, ranked in the top 100 in the world and a member of the elite Group of Eight.

Monash is a modern, worldwide, research-intensive university that provides world-class teaching and research in Australia and the Indo-Pacific.

Programme Offered | Major Electives offered include:

|

Intake | Feb, Jul |

Duration | 3 years (full-time) |

Indicative Fees (2022) |

Contact us right now for a free consultation if you’d like more details about the costs, the format of the programme, and the entry requirements!

#3 Curtin University

Curtin University is an Australian public research university with its headquarters in Bentley, Perth, Western Australia. Curtin University was formerly known as Curtin University of Technology and Western Australian Institute of Technology (WAIT). The largest university in Western Australia is named after John Curtin, who served as Prime Minister of Australia from 1941 to 1945.

In 1986, a law was passed by the Western Australian Parliament, giving Curtin University official recognition. Since then, the university has expanded, and in addition to its partnerships with 90 other universities in 20 other countries, it also has campuses in Singapore, Malaysia, Dubai, and Mauritius. The university has 95 professional centres and five core faculties. Curtin University is a member of the Australian Technology Network. Research is being done at Curtin University in a variety of academic and industrial sectors.

Programme Offered | Major Electives offered include:

|

Intake | Feb |

Duration | 3 years (full-time) |

Indicative Fees (2022) |

Contact us right now for a free consultation if you’d like more details about the costs, the format of the programme, and the entry requirements!

#4 Macquarie University

Macquarie University is located in the Macquarie Park neighbourhood of Sydney, Australia, where Macquarie University is The New South Wales Government established it in 1964, making it the third university to be founded in Sydney’s metropolitan area.

With five faculties, the Macquarie University Hospital, and the Macquarie Graduate School of Management, all located on the university’s main campus in suburban Sydney, Macquarie has a reputation for being a prestigious institution.

Programme Offered | Major Electives offered include:

|

Intake | Feb |

Duration | 3 years (full-time) |

Indicative Fees (2022) |

Contact us right now for a free consultation if you’d like more details about the costs, the format of the programme, and the entry requirements!

#5 Bond University

As a joint venture to manage the university’s land and finance the building project, Mr. Alan Bond, chairman of the Australian-based Bond Corporation, and Mr. Harunori Takahashi and Dr. Taro Tanioka, president of the Japanese-based Electronics and Industrial Enterprises International (EIE), established and funded Bond University in 1987.

Across its faculties of law, business, humanities and social sciences, and health sciences and medicine, as well as its institute of sustainable development and architecture, Bond University offers a wide range of internationally recognised undergraduate and postgraduate (coursework and research) degrees. Bond University has the lowest student-to-staff ratio in Australia and a close-knit community of about 4,500 students, allowing for small class sizes that promote active engagement and one-on-one mentoring. Bond University stands out from every other Australian university due to its individualised educational approach and unwavering focus on industry relevance.

Programme Offered | Major Electives offered include:

|

Intake | Jan, Sept |

Duration | 3 years (full-time) |

Indicative Fees (2022) |

Contact us right now for a free consultation if you’d like more details about the costs, the format of the programme, and the entry requirements!

For more information regarding the university, programs offered, entry requirements and fees, contact Excel Education.

Recommended Articles to Read

About The Author

Brenda Wong

Simplicity is the best.