What is an Actuary?

Actuarial science can be an ideal profession for individuals who love dealing with numbers and studying the behaviour of the data. With the increasing interest and the vast career opportunities of this profession, it has become a booming trend for aspiring university students to enrol to further their study. So before we deep dive into how to become an Actuary in Malaysia, let’s understand a bit about this profession.

Actuaries are professionals who use mathematical and statistical skills to assess and mitigate financial risk. Actuaries generally can be found working in diverse industries, including insurance, banking, and investment firms, with responsibilities such as managing risks associated with future uncertain events, such as natural disasters, accidents, and illnesses, and providing necessary guidance to make sound mitigating plans.

Becoming an actuary offers many great benefits, including a competitive earning potential, job security, diverse career options, meaningful work, and professional recognition. These benefits make a career in actuarial science an attractive choice for those interested in finance, risk management, or even data-related roles.

Type of Actuaries

Potential areas of Actuarial Science study include the following:

Type of Actuaries | Specialisation |

| Life Insurance | Prioritise the design and pricing strategy of life insurance products that include term life insurance, whole life insurance, and endowment plan |

| Health Insurance | Generally, focus on health and medical insurance design, to manage the growing needs of new medical scenarios while aligning business expectation |

| Pension | Advise trustees and companies on the management of their pension schemes, to help different pension schemes meet the needs of trustees, employers, and scheme members |

| Property and Casualty (P&C) | Analyse, evaluate, and manage the financial implications of future contingent events primarily in general insurance, including property, casualty, or any similar risk exposures |

Enterprise Risk Management | Specialise in the assessment and management of all types of risks faced by an organisation, including financial, operational, and strategic risks |

| Investment | Skilled in the analysis and management of investment portfolios, such as those held by insurance companies or pension plans |

| Reinsurance | Manage risk from insurance companies (reinsurance contracts) that transfer risk from one insurance company to another |

| Data Science | Use advanced data analytics techniques to extract insights from large data sets, often working in the areas of predictive modelling, machine learning, and artificial intelligence |

Do you require assistance in determining whether an Actuarial career is the right fit for you? Contact one of our experienced consultants immediately!

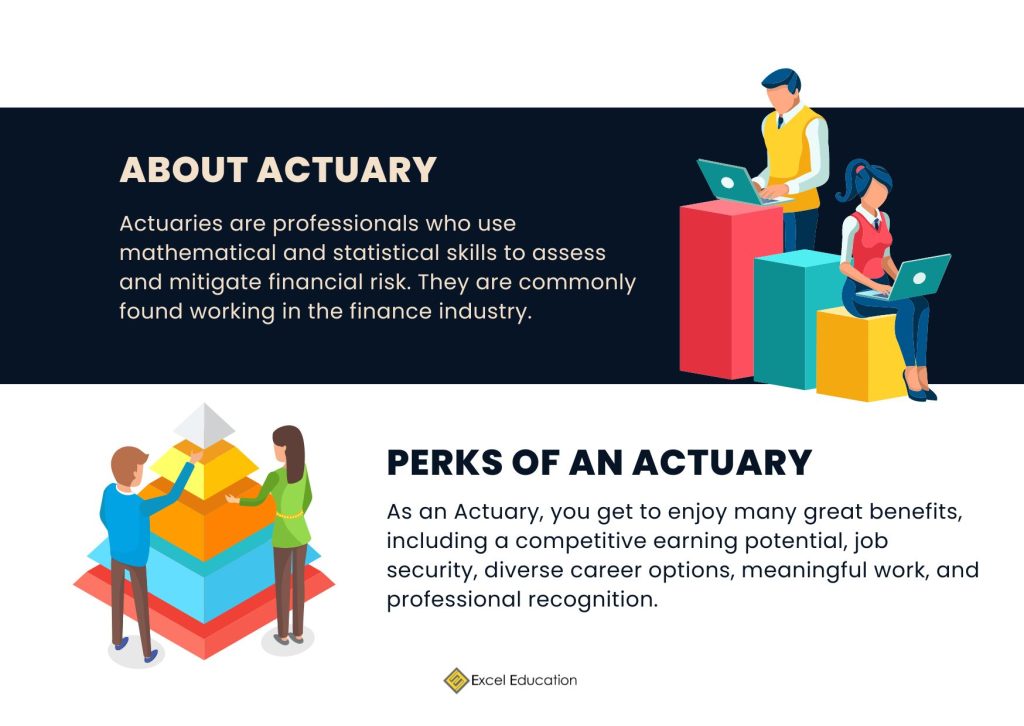

Skills Needed to be an Actuary

To be a successful actuary, one needs to possess at least the following skills to excel in their role:

1. Numeracy Excellence

You need to be good with numbers and have a solid understanding of calculus, statistics, and probability theory. The foundation in these areas is extremely crucial, as it is the cornerstone for your work when assessing and managing different data, which will translate to risk.

2. Analytics & problem-solving ability

You should be able to interpret complex data and derive meaningful insights from it. This ability allows you to provide accurate and relevant guidance on risk management to individuals and organisations so they can make sound business decisions.

3. Computer skills

With the need to massage data from all sources, you need to be proficient in statistical programming languages such as R and Python and have experience working with various statistical modelling software. This enables you to process large amounts of data and apply appropriate analytical techniques to draw insights.

4. Knowledge in business and finance

A sound understanding of business and finance is equally important to excel in this role. Having such knowledge provides you with a comprehensive view of risk management and other industry related updates. You should also have a good grasp of the financial regulations and standards that are relevant to their work.

5. Communication & Interpersonal Skills

As you will be working with a diverse group of stakeholders, including clients, colleagues, and regulators, you need to be able to communicate, break down complex data into easy-to-understand terms, and build relationships with them to ensure effective collaboration.

Are you eligible to study Actuarial Science?

Following are the general entry requirements to study Actuarial Science:

Academic Entry | Minimum Score |

Foundation | CGPA 2.00 |

Diploma | CGPA 2.00 |

STPM | 2 Principal Passes (Minimum grade C) |

UEC | 5 Bs (inclusive of Mathematics) |

A-Levels | 8 |

Australian Matriculation (ATAR) | 60% in 5 subjects (inclusive of Mathematics) |

IB Diploma | 26 points in 6 subjects (inclusive of Mathematics) |

Note: Universities may have different requirements. To learn more, get in touch with us!

Entry Level | Minimum Score |

IELTS | Band 5.5 |

MUET | Band 4 |

TOEFL | 46 |

Note: Universities may have different English Language requirements. To learn more, get in touch with us!

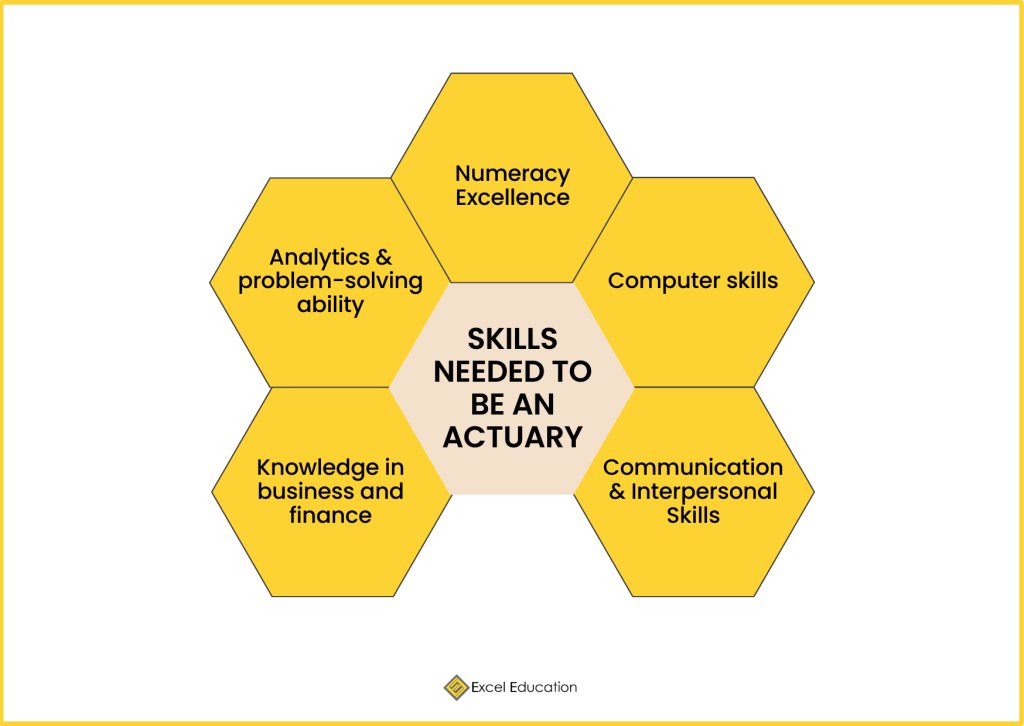

General Pathway to be an Actuary

Firstly, it is essential to pass your SPM examination. As Mathematics is one of the core skills required for this role, it is vital to study hard and aim for good grades (and do not forget about Additional Mathematics!).

After graduating from secondary school, it is recommended to enrol in a pre-university programme such as A-Levels, STPM, or any relevant Foundation or Diploma programme. This will provide a solid foundation for you to move up the university ladder and graduate as an Actuarial Science student.

Next, it is time to take on the challenge of earning your Bachelor’s degree in Actuarial Science. To become a certified actuary, you will also need to pass certain professional exams from recognized professional bodies such as the Society of Actuaries (SOA), USA, Institute and Faculty of Actuaries (IFoA), UK, Casualty Actuarial Society (CAS), USA, Institute of Actuaries of Australia, Canadian Institute of Actuaries, Canada.

However, some Bachelor’s degree programmes provide maximum exemptions from IFoA and SOA. Therefore, it is crucial to look through the programme outline and structure. If you would like to take on greater role in your future career, you can consider enroling to postgraduate study.

This is totally optional but it will help you to deepen your understanding and provide you with more opportunities in this role. To enrol, each university will have a different set of requirements. Reach out to us and let us help you to plan for your postgraduate journey.

Now that you have completed your study and professional exams, you are ready to enter the workforce as a certified actuary in Malaysia.

Top Universities to Study Actuarial Science in Malaysia

1. INTI International College Subang & Penang

NTI International College is a leading tertiary education institution with campuses across Malaysia, offering a wide range of programmes from pre-university and diploma to undergraduate and postgraduate degrees. Established in 1986, INTI is known for its innovative and industry-driven approach to education, providing students with practical skills and knowledge that prepare them for successful careers in their chosen fields.

|

Programme Offered |

Duration |

Intake |

Indicative Fees (2023) |

|

Actuarial Science Program (American University Program) |

4 Years |

January, May, August |

Local Students: RM41,052 – RM44,380 |

2. UCSI University

UCSI University is known for its academic excellence, innovative teaching methodologies, and state-of-the-art facilities. With a diverse student population from over 110 countries and partnerships with renowned universities around the world, UCSI University provides students with a truly international learning experience that prepares them for a global career in various fields of study, including business, engineering, architecture, medicine, and more.

Programme Offered | Duration | Intake | Indicative Fees (2023) |

| Foundation in Arts (Actuarial Science) | 1 Year | January, May, September | Local Students: RM18,012 – RM20,630 International Students: RM24,810 – RM30,600 |

| Bachelor of Science (Honours) Actuarial Science (1+2) | 3 Years | January, May, September | Local Students: RM72,420 International Students: RM83,400 |

Contact us right now for a free consultation if you’d like more details about the costs, the format of the programme, and the entry requirements!

3. Taylor's University

Taylor’s University is a private university located in Subang Jaya, Selangor, Malaysia. It was founded in 1969 as a college and became a university in 2010. Taylor’s University offers a wide range of undergraduate and postgraduate programs in various disciplines, including business, law, engineering, medicine, pharmacy, and education. The university is committed to providing quality education, promoting innovation and creativity, and producing graduates who are industry-ready and globally competitive.

Programme Offered | Duration | Intake | Indicative Fees (2023) |

Bachelor of Actuarial Studies (Honours) | 3 – 4 Years | January, March, August | Local Students: RM98,222 – RM107,930 |

Contact us right now for a free consultation if you’d like more details about the costs, the format of the programme, and the entry requirements!

4. Asia Pacific University (APU)

Asia Pacific University (APU) offers a wide range of undergraduate and postgraduate programmes in various fields, including Information Technology, Business Management, Engineering, Media and Design, and more. APU is known for its emphasis on technology and innovation, providing students with a modern and dynamic learning environment. APU’s industry partnerships and collaborations with top universities around the world provide students with ample opportunities for international exposure and practical learning experiences.

Programme Offered | Duration | Intake | Indicative Fees (2023) |

Bachelor of Science (Honours) in Actuarial Studies | 3 Years | March, July, September | Local Students: RM78,000 |

Contact us right now for a free consultation if you’d like more details about the costs, the format of the programme, and the entry requirements!

5. Heriot-Watt University Malaysia

Heriot-Watt University Malaysia is a branch campus of the prestigious Heriot-Watt University in Scotland, United Kingdom. Located in Putrajaya, Heriot-Watt University Malaysia aims to provide a high-quality education that is recognized globally, with a focus on delivering industry-relevant skills to prepare students for successful careers. The campus boasts modern facilities and a diverse student community, with a strong emphasis on innovation and research.

Programme Offered | Duration | Intake | Indicative Fees (2023) |

BSc (Hons) Actuarial Science | 3 Years | March, July, September | Local Students: RM131,760 |

Contact us right now for a free consultation if you’d like more details about the costs, the format of the programme, and the entry requirements!

For more information regarding the university, programs offered, entry requirements and fees, contact Excel Education.

Recommended Articles to Read

About The Author

Eric Chooi

Write, eat and repeat!