What is Actuarial Science?

Actuarial Science is a field of study utilising mathematics and statistical methods to evaluate risks and uncertainty, especially in the insurance or finance field. By evaluating risks and uncertainty, companies are able to make informed decisions which can mitigate losses or avoid unprofitable decisions and events.

Studies of Actuarial Science include a number of interrelated areas including mathematics, probability theory, statistics, finance, economics, and computer science. In an undergraduate degree, students would typically take up modules or subjects such as Probability Theory, Applied Statistical Models, Loss Models, Microeconomics, Macroeconomics, Statistics, Mathematics, and Calculus.

Actuarial Science is mainly involved in insurance and pension industry but it is also present in the financial department of various organisations. Pursuing a profession relating to Actuarial Science can be deemed both in-demand and lucrative.

If you’re wondering whether Actuarial Science is the right fit for you, keep on reading or contact our consultants!

Helpful Skills for studying Actuarial Science

- Incorporate optimal study style

A helpful tip for studying Actuarial Science is by incorporating your own personal study style together with a realistic study routine. From there, you can keep track of which topics or concepts you have covered and which you should review again.

- Determination and Hard Work

Actuarial Science is definitely not the easiest course to study and you might need to put in extra hours to catch up with all the practice needed to ensure the mathematical-related concepts stick, make sense, and evolve. You would also need determination and hard work to go through the many examinations you have to take.

- Numeracy Knowledge

Actuarial Science will incorporate numerics and figures, seeming as how it revolves around Mathematics, which will also extend when pursuing a career related to Actuarial Science. Accordingly, it is beneficial for you to have a solid numeracy knowledge together with an interest in the Mathematics subject.

- Computer Skills

Computer Skills would deem valuable as you pursue a professional career relating to Actuarial Science because you would typically have to deal with large amounts of data and utilise statistical modelling softwares in your day-to-day responsibilities.

- Analytical and Critical Thinking

Numeracy knowledge should be supported with analytical and critical thinking to develop solutions for complex problems in examination questions or when yielding results during your professional career in the Actuarial Science field.

Career Options with an Actuarial Science degree

- Actuary

- Actuarial Analyst

- Actuarial Executive

- Actuarial Scientist

- Financial Planning Advisor

- Budget Analyst

- Economist

- Investment Analysts

- Enterprise Risk Analyst

- Bank Executive

Eligibility for studying Actuarial Science in Malaysia

The following presents general entry requirements to study Actuarial Science in Malaysia:

Academic Entry

Academic Entry | Minimum Score |

Foundation | CGPA 2.00 |

Diploma | CGPA 2.00 |

STPM | CGPA 2.00 |

UEC | 5Bs including Mathematics |

A-Levels | 2 Passes |

Australian Matriculation (ATAR) | 60 |

IB Diploma | 24 |

Note: Universities may have different requirements. To learn more, get in touch with us!

English Language Entry Requirements

Entry Level | Minimum Score |

IELTS | Pass |

MUET | Pass |

TOEFL | Pass |

Note: Universities may have different English Language requirements. To learn more, get in touch with us!

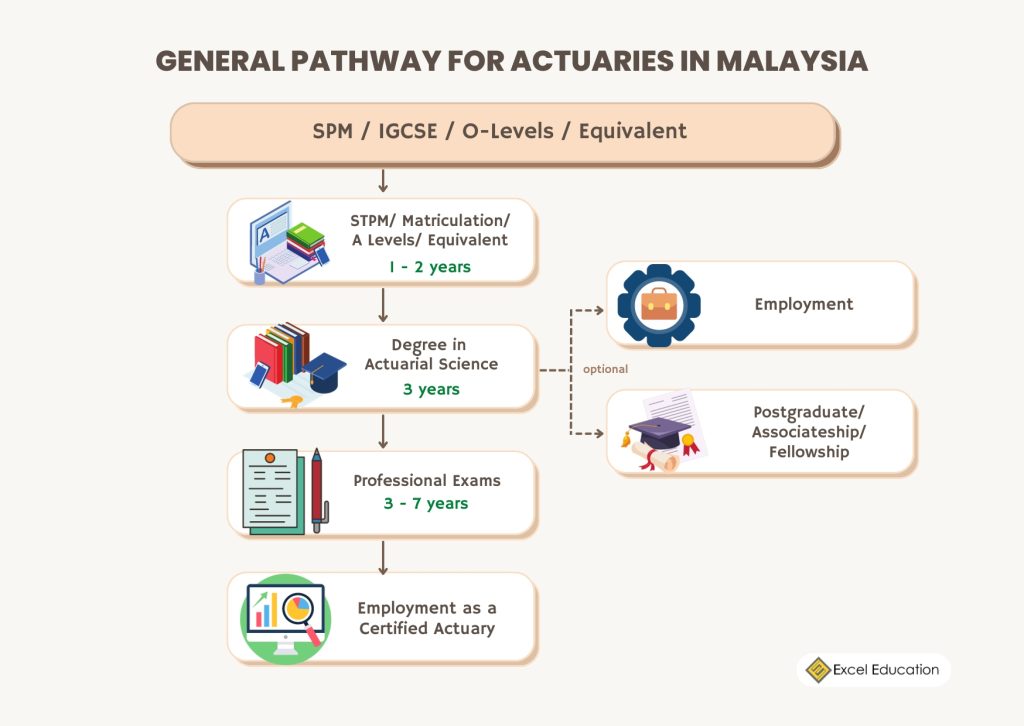

General Pathway for Actuaries in Malaysia

After completion of SPM or equivalent examinations, you can enrol in a relevant pre-university programme to qualify for a bachelor’s degree in Actuarial Science.

After earning a bachelor’s degree in Actuarial Science or a closely similar field in Mathematics, you have the option of starting employment. However, to be a certified Actuary in Malaysia, it is necessary for you to pass accredited certification exams.

A non-exhaustive list of the professional actuarial bodies acknowledged in Malaysia is provided by the Actuarial Society of Malaysia, together with details on examination exemptions in Malaysian universities and how to be able to obtain fellowships in accordance with the respective professional bodies. The Casualty Actuarial Society (CAS), the Institute of Actuaries of Australia, the Canadian Institute of Actuaries, the Institute and Faculty of Actuaries (IFoA), and the Society of Actuaries (SOA) are a few of the professional actuarial associations in Malaysia.

Some of the undergraduate programmes in Actuarial Science provide exemptions from certain professional examinations. For instance, the Bachelor of Science (Honours) in Actuarial Science offered by Asia Pacific University (APU) has maximum exemptions from IFoA and SOA. Students should peruse programme outlines and structures or reach out to us for more information.

There is also the option of taking additional certifications and licensing or consider postgraduate studies, such as enrolling into an Actuarial Science masters programme to gain more credentials.

After completion of your studies and professional exams, you can earn the certification of a certified Actuary in Malaysia.

For more information, you can read our article on How to be an Actuary in Malaysia, or you can get in touch with us!

Universities to study Actuarial Science in Malaysia

1. Taylor’s University

Taylor’s University is one of the private higher education institutions in Malaysia with consistent top rankings in the country as well as Southeast Asia. Taylor’s is an institution known by employers offering a broad range of programmes in the tertiary level with a solid student community support through its Taylor’sphere initiative.

Taylor’s Bachelor of Actuarial Studies (Honours) programme has accreditations exemptions from professional bodies including Institute and Faculty of Actuaries (IFoA), Society of Actuaries (SOA), Casualty Actuarial Society (CAS) and the CMT Association with additional accreditation from Bloomberg. The programme also offers the option of a four-year study duration where students join a long internship. Students also gain the opportunity to intern with renowned companies such as Maybank, EY, Deloitte, and PwC.

Programme Offered | Bachelor of Actuarial Studies (Honours) |

Duration | 3 or 4 Years |

Intake | February, April, September |

Indicative Fees (2024) | Local Students: RM 105,458 – RM 115,970 International Students: USD 27,823 – USD 30,736 |

Contact us right now for a free consultation if you’d like more details about the costs, the format of the programme, and the entry requirements!

2. Heriot-Watt University Malaysia

Heriot-Watt University Malaysia, located in Putrajaya, is an established higher education institution offering positive education which emphasises both academic excellence and holistic development of individuals, with its pioneer campus founded in 1821. The campus in Malaysia is named the first ‘green campus’ in the country presenting the sustainable values held by the institutions.

The BSc (Hons) Actuarial Science by Heriot-Watt University Malaysia is accredited by the UK Institute and Faculty of Actuaries (IFoA), Royal Statistical Society, and the Society of Actuaries (SOA) where students are granted exemptions. The programme aims to foster highly transferable mathematical skills in their graduates, ensuring they excel in the professional field of Actuarial Science.

Programme Offered | BSc (Hons) Actuarial Science |

Duration | 3 Years |

Intake | September |

Indicative Fees (2024) | Local Students: RM 131,760 International Students: RM 149,760 |

Contact us right now for a free consultation if you’d like more details about the costs, the format of the programme, and the entry requirements!

3. University of Southampton Malaysia

University of Southampton is one of the founding members of the Russell Group making the University of Southampton Malaysia as a notable learning institution with continually expanding global corporate connections. The University of Southampton Malaysia is located in Johor’s EduCity offering the same course content and teaching quality as its UK counterpart at a more affordable price.

The University of Southampton Malaysia offers a Bachelor of Science in Economics and Actuarial Science with comprehensive modules, state-of-art facilities, and personalised tutor support. Students also have the chance to proceed with a UK campus transfer depending on academic requirements and capacities.

Programme Offered | Bachelor of Science in Economics and Actuarial Science |

Duration | 3 Years |

Intake | September |

Indicative Fees (2024) | Local Students: RM 126,381 International Students: RM 146,622 |

Contact us right now for a free consultation if you’d like more details about the costs, the format of the programme, and the entry requirements!

4. Asia Pacific University (APU)

Asia Pacific University of Technology & Innovation (APU) is a prominent higher education learning institution known for its commitment in offering top-notch digital technology courses and ensuring our highly-skilled graduates continue to flourish and fill future digital job demands locally and globally.

The Bachelor of Science (Honours) in Actuarial Studies programme offered by APU is fully accredited by the UK Institute and Faculty of Actuaries (IFoA) with a comprehensive syllabus structured in tandem with the IFoA and the Society of Actuaries (SOA) as well as full exemptions from both professional bodies. Students will also undergo an internship for a duration of 16 weeks to ensure that they are industry-ready.

Programme Offered | Bachelor of Science (Honours) in Actuarial Studies |

Duration | 3 Years |

Intake | March, July, September, November |

Indicative Fees (2024) | Local Students: RM 92,000 International Students: RM 99,500 (USD 22,610) |

Contact us right now for a free consultation if you’d like more details about the costs, the format of the programme, and the entry requirements!

5. UCSI University

UCSI University has been steadily climbing the world university ranks with campuses in Kuala Lumpur, Springhill, and Kuching. UCSI holds on to the principles of audacity, perseverance, integrity, and excellence, offering students with a wide range of academic programmes equipped with state-of-the-art facilities.

The Bachelor of Science (Honours) Actuarial Science offered by UCSI University is professionally recognised by the Institute and Faculty of Actuaries (IFoA) and the Society of Actuaries (SOA) where you can take up preliminary examinations and exemptions. Students will also be granted the opportunity for industrial placement programmes with organisations such as AIA Berhad, Allianz Malaysia, Great Eastern Life Assurance, Prudential BSN Takaful, Tokio Marine Life Insurance, Zurich Insurance and more.

Programme Offered | Duration | Intake | Indicative Fees (2024) |

Bachelor of Science (Honours) Actuarial Science | 3 Years | January, May, September | Local Students: RM 72,420 International Students: RM 83,400 |

Bachelor of Science (Honours) Actuarial Science and Finance | 3 Years | January, May, September | Local Students: RM 73,460 International Students: RM 84,450 |

Bachelor of Science (Honours) Actuarial Science with Data Analytics | 3 Years | January, May, September | Local Students: RM 77,590 International Students: RM 93,850 |

Contact us right now for a free consultation if you’d like more details about the costs, the format of the programme, and the entry requirements!

For more information regarding the university, programme offered, entry requirements and fees, contact Excel Education.

About The Author

Hannah Hir

Hannah appreciates various art forms, especially Asian literature, film and music. Most of her favorite Malaysian kuihs are green-coloured.